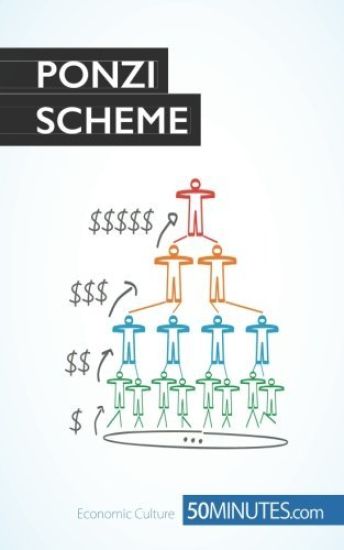

In a Ponzi scheme, new investments are used to pay existing investors, to cover the cost of salespersons, and to finance the Ponzi schemer's satisfying lifestyle. Although Charles Ponzi recruited investors in Boston in 1919 and died in 1949, his design and mode of operation are alive and well today. Indeed, losses from Ponzi schemes in the United States are equal to losses from shoplifting. Ponzi schemes catch in their net highly sophisticated individuals and institutions as well as low-income and middle-income investors, and these schemes have attracted investors all over the world, in Russia, England, India, Albania, Romania, Portugal, Costa Rica, and elsewhere. Looking into the innumerable cases of Ponzi schemes throughout the years, Tamar Frankel observes that even though patterns began to emerge in the stories of con artists and their victims' behavior, the main puzzles still remain: How do con artists dazzle and lure wealthy and educated individuals and representatives of large institutions to hand over huge sums of money? How do con artists divert investors' attention from the soft spots of their stories? And while there are so many books and articles about Ponzi schemes, their warnings and constant advice on how to detect and avoid con artists go unheeded. In The Ponzi Scheme Puzzle, Frankel explores con artists' fascinating power of persuasion and deception, and analyzes their subtle signals that mimic truth and honesty. She identifies the reasons for the local and global success and longevity of such schemes and seeks to understand the nature of the con artists and their victims. She combines the many stories of Ponzi schemes, derived mostly from court cases and newspaper articles, to show the patterns of such frauds, the nature of the con artists, and character of their victims. These patterns tell us much about human nature, about our society, and about ourselves. The book first analyzes the design and pattern of the con artists' attractive offers and how they hide deceptions, then deals with the ways in which schemes are advertised and sold. Next, it focuses on the core of con artists' success, then discusses the characters of con artists and their victims. Finally, Frankel offers a number of observations on the lessons we can learn from these stories and analyses. She concludes that our attitude to con artists is ambivalent and uncertain perhaps because their behavior is so close to the behavior of honest people; or perhaps because they act like the social leaders with whom they are likely to mingle, or perhaps their actions are necessary to shake up a complacent society. Therefore, she writes, self-protection from charming, dangerous con artists must involve self-examination: once we recognize our own tendencies we can better protect ourselves from their toxic attraction.